Calls for resolution of Palestinian, Kashmir disputes in accordance with UN Security Council resolutions

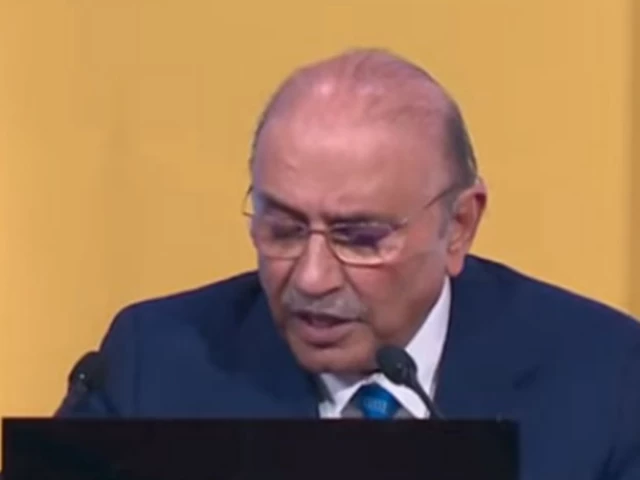

President Zardari addressing World Summit for social development in Doha Novemeber 4, 2025 Photo: Radio Pakistan

President Asif Ali Zardari has emphasized the need for social integration based on equality, solidarity, and respect for human rights.

Addressing the World Summit for Social Development in Doha on Tuesday (Today), he called for the eradication of poverty in all its forms, promoting full and productive employment and decent work for all. He said we must ensure global institutions are inclusive and responsive, especially to the needs of the Global South.

President Asif Zardari is currently in Doha to attend the Second World Summit for Social Development from November 4 to 6, where he will reaffirm Pakistan’s commitment to working with development partners and multilateral institutions to mobilise financing for social protection and green employment initiatives.

The moot is being held under the auspices of the United Nations General Assembly.

According to the President’s Secretariat, the summit has brought together world leaders and policymakers to discuss ways of advancing social development, promoting decent work and employment opportunities as well as strengthening inclusive safety nets.

“Our vision for inclusive and sustainable development is fully aligned with the spirit of Doha declaration,” the president stated.

Asif Ali Zardari mentioned that Pakistan’s flagship Benazir Income Support Program has empowered over nine million families with income assistance as well as healthcare and educational support. “This landmark program remains a model for the rest of the world and has helped transform millions of lives.”

The President said sustainable development goals also remain within our sight. “Through the National Internship Program, we are empowering the youth”, Zardari said as Pakistan aims to raise the literacy rate to ninety percent and ensure that every child is in school. Through the National Internship Program, we are empowering the youth.

Referring to the impacts of climate change, the President said Pakistan is investing in resilient adaptation, ensuring that growth remains green, inclusive, and long-lasting. The President also called for the resolution of the Palestinian and Kashmir disputes in accordance with the UN Security Council resolutions.

Read: President to attend world summit on social development

He said Pakistan also faces a new threat in the form of the weaponisation of water. Regretting the violation of the Indus Water Treaty by India, he said such tactics cannot and will not succeed.

The President also called for the resolution of the Palestinian and Kashmir disputes in accordance with the UN Security Council resolutions.

Violations of Indus Water treaty

The recent conflict between Pakistan and India marked a major military escalation between the two nuclear powers. Tension between Pakistan and India increased after the April 22 Pahalgam attack in Indian Illegally Occupied Jammu and Kashmir (IIOJK), which killed 26 tourists.

In response, India undertook a series of hostile actions the next day, on April 23, including suspending the 65-year-old Indus Waters Treaty (IWT), cancelling visas for Pakistani citizens, closing the Wagah-Attari border crossing, ordering the shutdown of the Pakistan High Commission in New Delhi. India and Pakistan subsequently reduced diplomatic staff at their respective embassies in each other’s countries.

Read more: Pakistan rejects India’s ‘Operation Sindoor’ claims as baseless, provocative

Pakistan strongly rejected the accusation, calling it unsubstantiated, but took reciprocal measures through its National Security Committee (NSC). These included halting trade with India, closing Pakistani airspace to Indian aircraft, and other countersteps.

On the night of May 7, the Indian Air Force launched an unprovoked attack on civilian targets in Pakistan. The Pakistan Air Force (PAF) immediately retaliated and shot down at least six IAF jets, including three French-built Rafales.

Escalating further, on the night of 9–10 May, India launched another round of strikes against Pakistan, but this time targeted military sites and airbases.

In retaliation, Pakistan launched Operation Bunyanum Marsoos, striking back at Indian military installations, including missile storage sites, airbases and other strategic targets. The early morning strikes came as a shock for the Indian military leadership, who had underestimated Pakistan’s response to their unprovoked attacks.